"That's not what it says on page 232." And I immediately lost all credibility with this class and, when word got around, the other five classes that I was teaching each day. I didn't know the answer but I answered anyway. One day in class, a kid who sat three rows back on the left hand side, asked me a question. But it was an eighth-grade class and I figured I could probably stay ahead by just reading 20 pages ahead in their textbook every night. I was teaching Earth Science, which I had never taken before. I started my career in Teach for America.

#Coinbase app update professional#

What's been your biggest professional blunder and how did it help you?

We need to make sure that we're helping all those companies that may come from a different orientation to keep building up and bolstering the safety and soundness of the industry. But we live in a world where everything is connected, from your thermostat to your television to your watch to the computer you use to access your bank account. As more and more companies embed financial services into what the company does, that creates a lot of convenience for people and for businesses and that's great. The thing that really needs to keep all of us up at night is really around cyber. What fintech trend is most troubling for you? Many of the societal issues that need to get solved have a massive financial component to it. The "S" has really become more important. That's a little bit broader than fintech, but it ties to fintech really closely. I'm probably most excited about the sort of emergence of the S in the middle of. What fintech trend are you most excited about? Vanessa Colella, chief innovation officer, Citi The incidents at Coinbase and Cash App make even clearer the risks fintechs and their customers must grapple with.

#Coinbase app update software#

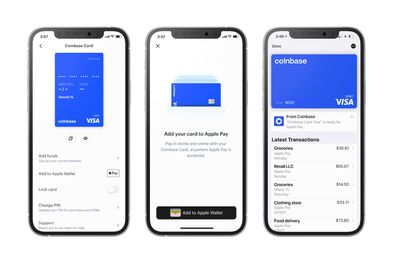

Coinbase is working to make its software tools more secure, Casper Sorensen, VP of Customer Operations, told Protocol.Crypto exchanges' adherence to industry regulations - like KYC (know your customer) and AML (anti-money laundering) - is generally inadequate.Between 20, crypto users lost roughly $8 billion to criminal scams and security breaches.For defrauded customers, that's a bug, but for hackers, it's a feature. Transactions can't be easily reversed.The Coinbase breach underscores security worries about Bitcoin and other crypto currencies. Square says it takes fighting fraud seriously, and has been investing in new tools and adding staff to "prevent, detect and report bad activity," a spokesperson told Protocol.Ĭrypto is vulnerable.As Yahoo Finance noted, Cash App has generally dismal reviews on the Better Business Bureau site, which logged more than 2,500 complaints in the past 12 months.It's not that surprising: Payment apps historically have seen higher fraud rates than traditional tools, such as credit and debit cards.But there also has been an increase in user reviews mentioning "fraud or scam." The crisis led to a big spike in downloads of mobile payment apps.The incidents - which didn't appear to represent a breach of Coinbase or Square's systems - highlight how securing customer accounts has become more challenging as fintech expands, especially in the pandemic. Some customers have complained that the companies aren't doing enough to protect them or to explain what happened. "Within a couple of minutes, it was all taken away from me," a Coinbase customer (and one-time employee) told the New York Times. Hackers targeted users of Coinbase and Square's Cash App, reportedly draining some accounts.

0 kommentar(er)

0 kommentar(er)